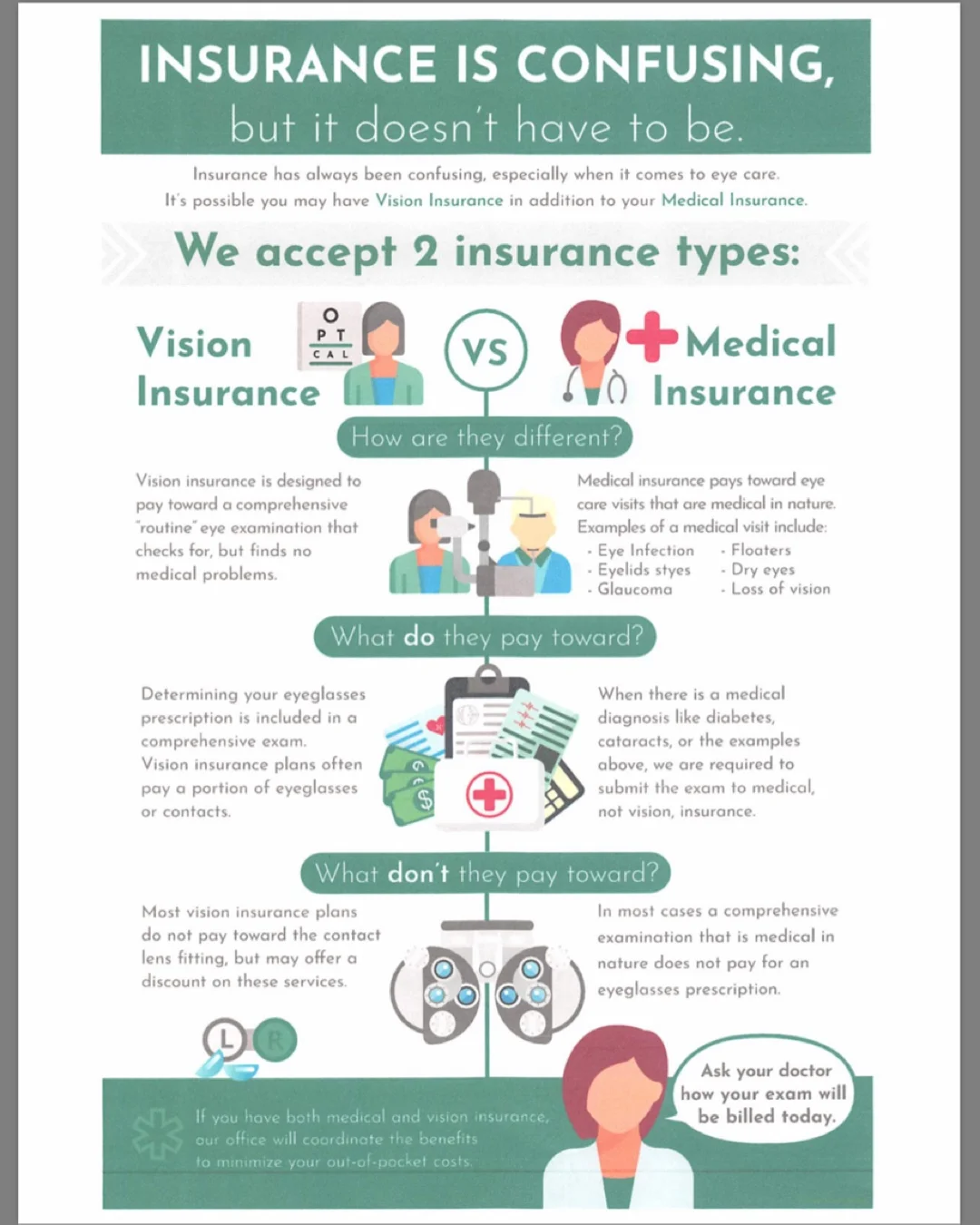

Difference between Vision and Medical Insurance

We accept 2 types insurance, medical and vision.

Vision

Vision insurance is actually a vision benefit. It is designed to pay toward "routine" comprehensive eye examinations. A "routine" eye examination checks for, but finds no medical problems. The refraction (determination of the eye's prescription) is included, and since there are no medical problems, there is no discussion of problems or follow-up needed. Most vision insurance plans do not pay toward the contact lens portion of the examination, but may offer a discount on these services. Vision insurance plans often pay a portion of (or offer a discount on) eyeglasses or contact lenses.

Medical

Medical insurance pays toward eye care visits that are medical in nature. An emergency visit, or one focused on a specific eye problem, would be submitted to medical insurance. Some examples of a medical visit are: eye infection, floaters, eyelids styes, dry eyes, glaucoma treatment, loss of vision caused by a medical condition of the eye, etc.

Medical insurance may also pay toward a comprehensive examination if there is a medical reason for it (such a s diabetes, cataracts, or any of the previously listed reasons). If there is a medical diagnosis, we are required to submit the examination to the medical, not vision, insurance.

If you have both medical and vision insurance plans, our office will coordinate the benefits to minimize your out-of-pocket costs.